As hospitals and health systems seek to improve financial performance, it becomes increasingly important to identify which elements of the revenue cycle are performing well, and which areas have opportunities for improvement. Few industries feature the complex mix of internal and external challenges to optimizing revenue that healthcare organizations must overcome. One area that exemplifies these issues is charge capture, which also makes it a prime candidate for potential issues.

To identify and address those issues, providers will often conduct a charge capture audit. If done correctly, charge capture audits can deliver substantial improvements in terms of capturing lost revenue, ensuring compliance and improving overall financial performance.

Check out our Video Guide on Charge Capture Audits

Contents

What is charge capture and why is it important?

Charge capture involves the documentation, posting, and reconciliation of all charges for medical services rendered during a patient encounter. This includes labs, therapies, diagnostic services, pharmacy, and all aspects of patient care delivery such as procedures and diagnoses. The process of charge capture occurs in the middle of the organization’s clinical and financial systems, which means the data is input across multiple disparate systems from a variety of roles.

A primary goal of accurate charge capture is ensuring revenue. If there are missing or inaccurate charges from a patient encounter, the provider will miss out on the associated revenue. For organizations already running extremely tight margins, any missing revenue inhibits their ability to sufficiently fund their operations, invest in new equipment or add needed staff to maintain service levels.

Incorrect charge capture also impacts financial performance in other ways.

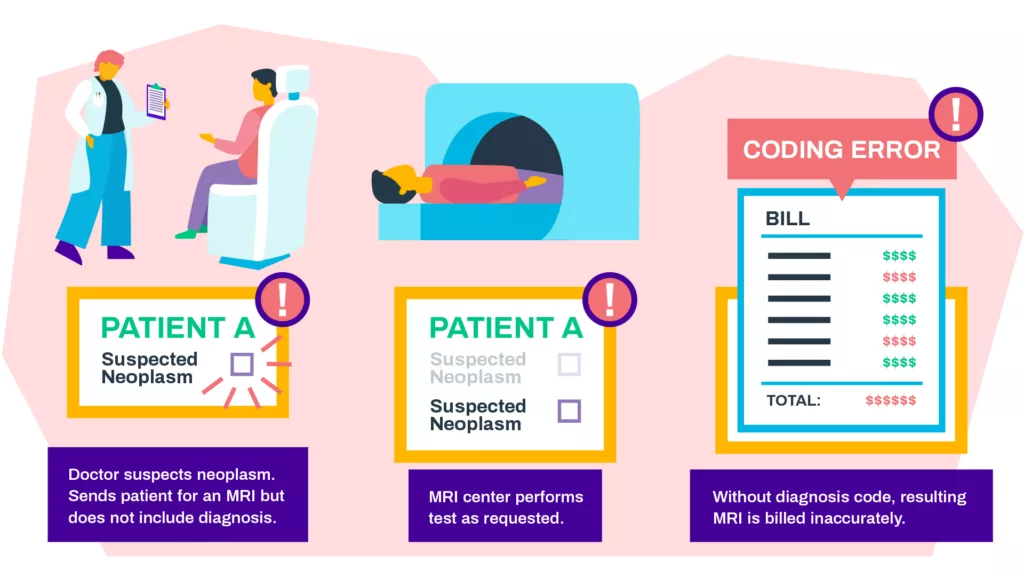

In preparing a claim for payer reimbursement, providers must convert the charges, along with other medical records, clinical and administrative data, into medical coding. Charges play an integral role in ensuring accurate coding, as they not only reflect the individual services rendered but also support the use of specific revenue codes, such as DRGs (diagnosis-related groups) and HCCs (hierarchical condition categories), that drive payment. Having the correct charges helps ensure accurate coding and increases the chance of prompt payment.

From a billing perspective, payers will often scrutinize charges from a variety of angles, which means providers are tasked with ensuring all charges are captured correctly, supported by the necessary documentation and revenue codes, and meet specific payer requirements such as medical necessity or pre-authorization. If missing charges are identified after claim submission, an amended claim must be created and reviewed for accurate coding, then re-sent to the payer.

Complete master file audits in seconds.

ChargeMaster management can be difficult, and with ever-growing complexity, discrepancies can feel impossible to track down. With Compare, even large data system transitions can be audited with ease in just seconds.

How does charge capture fit into the revenue cycle from an operational and strategic perspective?

Charges represent the billable transactions that occur during care delivery, so there can be dozens or even hundreds of charges incurred across the duration of the patient encounter. Due to operational constraints, these are difficult to manually review for accuracy, yet daily reconciliation from the appropriate department is the best practice for ensuring accurate reimbursement and revenue integrity from all encounters.

Some areas of the organization are particularly difficult from a charge capture perspective. For instance, the emergency department features highly complex services and unique circumstances, such as a service being administered as an outpatient and then as an inpatient. The result is a compound/complex medical record that’s challenging to convert into accurate coding for the appropriate reimbursement.

From a payer perspective, some charges are also frequently scrutinized. High-priced pharmacy items are often subject to reviews specific to the appropriate usage. Medications administered across departments can also be subject to reviews as they may be duplicative.

How & why does the charge capture process fail?

Despite the direct impact of charge capture on revenue cycle performance, almost all providers likely have some form of inefficiency or opportunities for improvement in their charge capture process. Charge capture issues can come from a variety of sources.

Staff-based Factors

- Healthcare providers are often responsible for the charge entry process, yet they often lack understanding of its importance and see it as a low priority.

- Charge capture is also managed by administrative and point-of-service roles, which can be subject to high turnover and poor training.

Organizational and Process-based Factors

- Responsibilities for charge capture are often decentralized across departments, which makes it hard to review and report on performance.

- Organizations often lack formal policies and standards for charge capture.

- Manual review of charges on a daily basis is very time-consuming and often gets bypassed.

With multiple entry points, codependency’s, and other factors, it’s not hard to appreciate the effort needed to ensure accurate charge capture.

Financial Performance

- Revenue Leakage (missed charges)

- Payment delays or denials and associated costs to appeal

- Poor cash flow

- Inadequate data for contract negotiation

Compliance Exposure

- Audits from payers

- Payment recoupments after initial payment of claim

- Fines and reduced contracts from payers

- Failure to comply with regulatory updates

Patient Satisfaction

- Incorrect billing can contribute to higher patient payments and potentially lead to medical debt

- Lower ratings in CMS Star rating system

How to approach a formal charge capture audit?

Charge capture audits should be focused on reviewing the internal controls around the existing process. It should provide an assessment of current processes for initial charge capture, tracking of charge accuracy and reporting on overall effectiveness across all encounters. This should help isolate where issues are occurring so you can identify the process or system improvements needed to prevent erroneous charges.

Who should be involved with establishing a charge capture audit process?

Given the unique nature of how charges are input, the team overseeing your charge capture audit should include stakeholders from your financial, IT, and your clinical departments. Ideally, a charge capture audit will be spearheaded by a Revenue Integrity team member. This will provide valuable, relevant insights into the current state from a user and system perspective. It will also assist with assessing root cause and developing corrective steps and implementing the necessary improvements.

Perhaps most importantly, having representatives from these roles involved will be crucial to implementing the necessary process improvements. As with any change management, success is dependent on buy-in from all respective stakeholders. Having champions from of the financial, IT and clinical departments on your charge capture auditing team will help explain the need for changes—and the overall benefits— to their respective teams.

What should be expected from a charge capture audit?

Upon completion, a charge capture audit should provide actionable insights into the following:

- An understanding of the current state of charge capture at a department level, including the systems, processes and personnel involved.

- A summary understanding of charge capture deficiencies, which can include failure to post charges, posting charges after billing cycle, charging for incorrect service(s), charging the wrong patient or multiple accounts, service not listed on charge sheet/charge screen, and failure to reconcile charges or review error reports.

- A summary understanding of interdependencies that contribute to erroneous charge capture, such as how one department’s role impacts performance later in the process.

Next Steps

Upon completion of a charge capture audit, the team should compare their results to industry best practices in charge capture accuracy. This helps establish context for how prevalent certain issues may be and where you should focus your efforts. After this, you can prioritize issues to pursue, begin to assess the root cause and corrective actions in terms of initial charge capture and monitoring controls.

An action plan to implement the necessary process improvement steps should be developed, agreed upon and enacted to improve the charge capture practices. These may include the use of charge capture solutions to deliver the process improvements needed to ensure accurate capture. Staff training in the appropriate department where issues occur can also eliminate costly errors that result in missing charges and subsequent lost revenue.

Finally, after the corrective actions have been taken, the team should re-audit the system to assess impact on charge capture performance. If substantial deficiencies remain, the team should troubleshoot the root problem to continue addressing issues in each appropriate department or process until the desired results are achieved and you can consistently ensure accurate capture.

A successful charge capture audit process is not easy, but by providing a full picture of how and where you’re failing to accurately capture all charges, you can improve revenue integrity across your organization.

Charge Capture Audits Frequently Asked Questions

Charge capture is the documentation and reconciliation of charges for medical services provided to patients. It ensures accurate revenue, compliance, and prompt payment.

Review internal controls, assess current processes, and identify areas of improvement to prevent erroneous charges.

Stakeholders from financial, IT, and clinical departments, ideally spearheaded by a Revenue Integrity team member.

A clear understanding of the current state, charge capture deficiencies, and interdependencies that contribute to errors.

Compare results to industry best practices, prioritize issues, implement process improvements, and re-audit the system to assess the impact.

Discover Streamline Health’s innovative revenue management solutions to optimize your healthcare financial performance. Experience the benefits of our medical billing and coding software, charge capture software, and chargemaster management products under one roof. Our comprehensive platform offers the following:

- Seamless integration with your existing systems

- Streamlined workflows and maximized revenue capture

- Enhanced efficiency through advanced analytics and reporting

- Tailored solutions for healthcare providers

Start your journey toward an optimized revenue cycle with a demo of our automated revenue cycle management software. Explore our products or connect with our sales team to find the perfect fit for your organization.