America is fortunate to have an incredible healthcare delivery system featuring some of the world’s finest clinicians, therapeutic options, and facilities. But sustaining this system requires an equally impressive revenue cycle operation to ensure full and accurate reimbursement for the care delivered.

Central to any provider’s revenue cycle operation is its medical coding team, which is responsible for translating various content from the encounter (patient and payer information, medical records, clinical documentation, diagnoses, procedures, and other services rendered, etc.) into a rather complex claim that’s submitted for payment.

Check out our Video Guide on Medical Coding Audits

Contents

Medical Coding: Translating Care into Claims

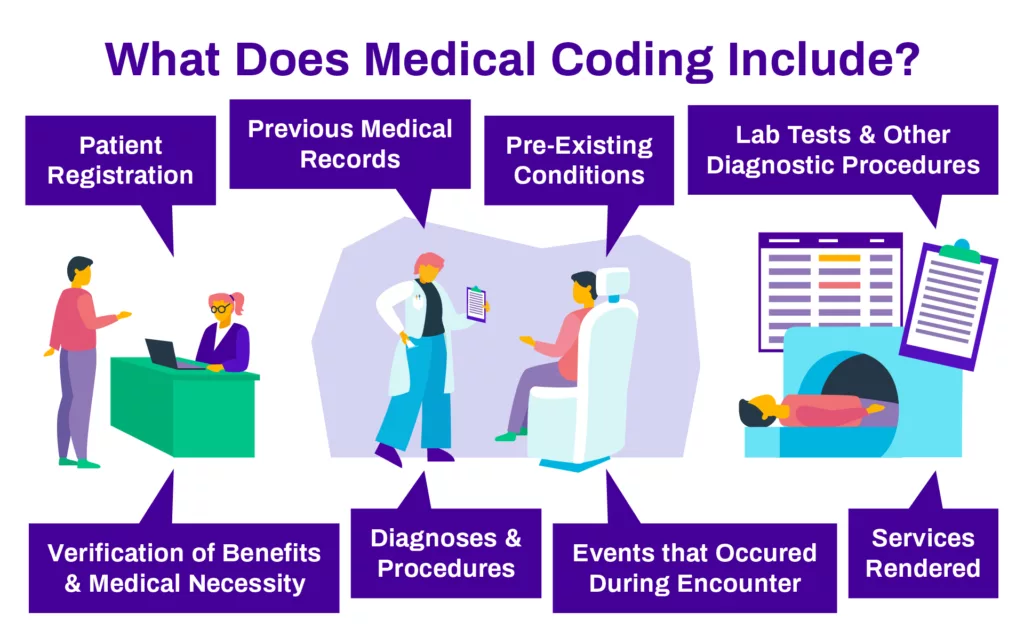

Medical coding is the process of converting patient encounters into billable claims and is handled by a certified professional coder. This coding helps the provider organization, payer entities, and healthcare agencies track many elements of healthcare across the country. Medical coding can include data from all aspects of patient care from admittance to release, including:

- Patient registration

- Verification of benefits and medical necessity

- Pre-existing conditions

- Diagnoses and procedures

- Services rendered

- Events that occur during the encounter

- Previous medical records and documentation

- Lab tests and other diagnostic procedures

As a foundational element to an effective healthcare revenue cycle, medical coding transfers information into universal alphanumeric codes used for claims payment.

Insurance companies use medical coding to pay for policies and services, as well as to keep track of provider performance. Medical billing and coding information can also go into patient files to ensure all providers access the same history to treat conditions properly.

Coding Categories

The types of codes used to create billable claims are managed by multiple sources, including CMS, WHO and the AMA. These agencies created unique coding sets to represent distinct types of data associated with patient health and the delivery of healthcare services. Each entity typically updates their medical codes at least annually, and it’s imperative for the coding operations to stay current with new codes and usage guidelines.

To avoid using outdated codes, it’s imperative for providers to ensure all medical coders are familiar with the latest update from the following coding sets:

- Current Procedural Terminology (CPT) from the American Medical Association (AMA)

- Healthcare Common Procedure Coding System (HCPCS) from the Centers for Medicare and Medicaid Services (CMS)

- International Classification of Diseases (ICD) from the World Health Organization (WHO)

Complete master file audits in seconds.

ChargeMaster management can be difficult, and with ever-growing complexity, discrepancies can feel impossible to track down. With Compare, even large data system transitions can be audited with ease in just seconds.

Coding Issues

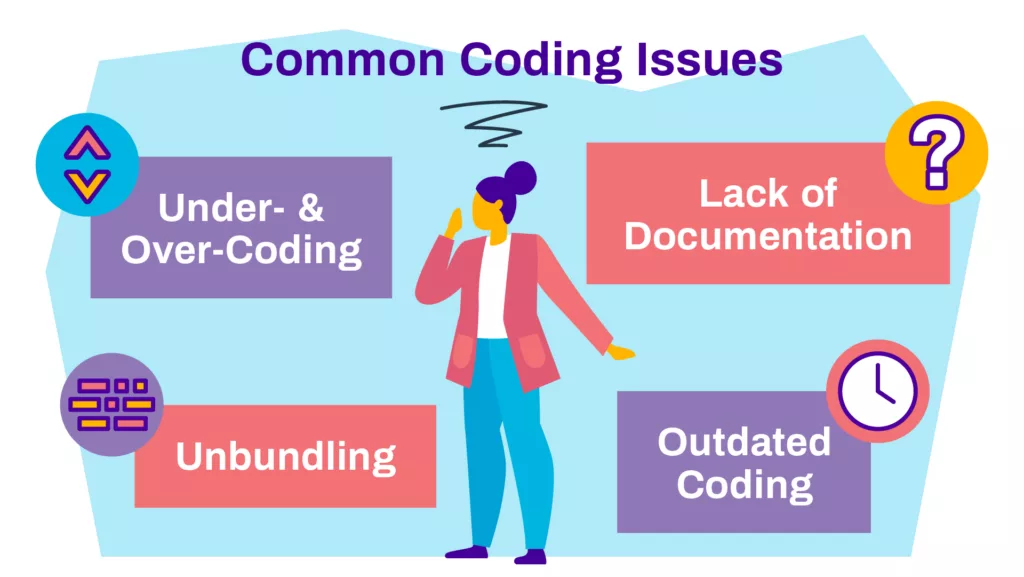

Errors in coding can manifest in a variety of ways, but they typically fall into the following categories:

- Under coding or over coding

- Unbundling

- Lack of documentation

- Outdated coding

Under coding or Over coding

Under coding or over coding refers to improperly coding a procedure in a manner that impacts how it’s reimbursed. In under coding, the medical coding professional may use an incorrect code for a given diagnosis, procedure or service, resulting in the less reimbursement for the claim than the provider is due. This shortfall is commonly called revenue leakage or lost revenue.

With over coding, the medical coder includes elements that are not consistent with the patient experience such as an erroneous diagnosis or procedure codes for services that weren’t actually provided. In this case, the claim would request more reimbursement than the provider is due, which is called overbilling.

What is Unbundling in Medical Billing?

Unbundling is an error with medical coding that usually occurs as a result of poor coder training. It happens when the coder lists multiple codes on a patient’s record where there is one code that encompasses all options. Unbundling typically happens because the medical coder isn’t aware of current procedural terminology. Ensuring coding staff stay current with the latest medical codes can help eliminate this issue.

Lack of Documentation

A lack of documentation has a direct impact on the ability to code a case correctly. If a medical coder doesn’t have the supporting documentation on a patient, certain clinical elements or medical procedures, they can’t input the correlating code(s) to identify the presence of that factor in serving the patient and generate the corresponding revenue for the organization. In many cases, the absence of one key data point, such as a diagnosis code, can have a ripple effect on the accuracy of the coding and the amount of revenue it can legitimately reflect.

Outdated Coding

Another challenge with medical coding is the continual updates to codes from the issuing agencies. Regular updates—ranging from quarterly to annually— provide new codes for use in addressing specific diagnoses, procedures, and other clinical factors. Agencies also issue new guidance for existing codes. This makes it imperative that coding professionals stay updated via regular reviews of each coding category, and failure to do so results in payers pushing back against claims that don’t reflect the latest guidance and usage parameters.

Medical Coding Auditing

As patient care complexity grows, so do the subsequent challenges with accurately coding the supporting claims for reimbursement. To ensure the accuracy of medical coding—and subsequent revenue capture— healthcare organizations conduct routine audits on coded cases. An effective medical coding audit program is essential to ensuring consistent, accurate revenue from care delivery at that healthcare facility.

There are many benefits to a coding audit program, which fall into four broad categories:

- Accurate reimbursement

- Accurate reporting & data

- Coder education & development

- Increased compliance

Whether managing internally or through a medical coding audit services vendor, a well executed medical coding audits program should deliver these benefits.

Accurate Reimbursement

Having an encounter appropriately coded directly impacts the reimbursement for that specific encounter. By identifying and correcting over- and under coding, the provider is appropriately reimbursed. Another benefit is faster payment and avoidance of the expense and disruption of reviewing and appealing denials. Beyond individual encounters, coding also drives metrics which further impact the organization’s reimbursement, such as case mix index (CMI) and risk adjusted payment models.

Accurate Reporting and Data

Coded data also supports non-financial metrics at the organization. Accurate coding is paramount to ensuring metrics such as severity of illness and risk of mortality are correctly reflected. Coded data is also leveraged during managed care contract negotiations, as well as in consumer scorecards and comparison studies (e.g., Healthgrades, PQRS, etc.). In addition to increasing coding accuracy, an effective audit program will enable better internal decision making and more precise external reporting.

Coder Education and Development

The transition from ICD-9 to ICD-10 marked a substantial shift in the coding environment. However, each of the agencies issue regular updates with new codes and new guidance for existing codes. This increases the need to identify recurring errors and provide targeted training. Through auditing, healthcare organizations can continually review coding for trends that identify patterns, such as issues from a specific coder or facility, issues regarding specific services or codes, failure to meet payer rules, etc. More developed audit programs will package and return that information to coders in the form of actionable feedback for ongoing development.

Increased Compliance

An audit program forms the backbone of a robust coding quality compliance platform – something all providers should have in place. There are numerous regulatory agencies and agents examining coding quality today. The combination of natural intricacy and large volume makes 100% coding accuracy a constant target rather than a regular reality; however, demonstrating a commitment to that target is a necessity in today’s regulatory environment. Many healthcare organizations have a quality assurance process that supports the medical coding audit program as well.

If planned and executed correctly, a well-designed audit program can serve all four of these areas for healthcare organizations.

Scoping a Medical Coding Audit

Providers today are likely coding encounters across multiple modalities of care, potentially for both the facility and the professional. The most common scopes for an audit are:

- Inpatient MS-DRG

- Inpatient APR-DRG

- Hospital outpatient APC

- Hierarchical condition category (HCC), and

- Professional fee (Pro-fee) services

All of these payment methodologies pose varying degrees of risk for material errors in coding.

On a case-by-case basis, the potential financial impact is greater for inpatient encounters. However, the sheer volume of outpatient and professional fee coding can mean that material errors in those areas can easily add up to substantial amounts.

In short, a well-rounded audit program should be evaluating the coding accuracy of all encounters, regardless of treatment setting. Not only does this optimize revenue and ensure compliance, it also increases the chance to reveal a variety of issues such as poor medical record documentation and faulty processes.

Optimizing Audit Impact

Clearly, auditing 100% of coded encounters would be prohibitively expensive and inefficient, so how should a provider organization establish the appropriate scope for their audit work?

The best approach is to perform targeted audits on a sample of accounts. The most efficient sample size is the smallest one that best reflects an accurate representation of their coding accuracy and risk. Given the large volume of overall encounters in the average provider organization, a good rule of thumb is to audit a minimum of:

- 2% of inpatient encounters

- 1-2% of outpatient and professional encounters

Establishing the size, however, is only one aspect of efficient coding audits. The sample selection methodology is equally important.

Sampling Methodology

There are three categories of sampling methodology: random, stratified random and focused. A random sample is pulled randomly, but it’s important to it provides claims that are broadly representative of your encounter population.

A random sample, however, will still result in many accounts being audited where there was no real risk of errant coding. Even a stratified random sample, where you pull random samples across different DRGs, coders, etc., can result in fruitless coding audits.

This can be avoided with a focused sample. It can be focused in whole or in part; for example, a provider could pull a random sample that also overweights an area where they know problems have existed in the past.

A focused sample can also be manually focused or technology-enabled. A manually focused selection sample relies on the experience of the sampler to oversee account selection to include known problem areas such as a new coder, or care areas where the organization’s coding has a history of issues.

The Recommended Approach

A technology-enabled focused sample selection methodology uses rules-based software algorithms to identify accounts with a high probability of having coding and documentation errors. In either instance, if properly executed, a focused sample should increase the efficiency of the coding audits.

The best practice is a technology-enabled sampling methodology that data mines the entire population of encounters and flags those that have the greatest potential for both reward and risk. This helps assure the best use of staff members’ time and focus.

Audit Frequency

There are two primary reasons to perform audits on a more, rather than less, frequent cadence. The first is the 60-day Medicare re-billing rule broadly in place. If an error is discovered and the correction results in a higher reimbursement, you only have 60 days to re-submit the claim.

The second factor reinforcing the need for more frequent auditing is that the training based on the audit findings can be performed closer to when the coding error occurred. If coding and billing audits are performed monthly, then new patterns of errors can be detected and subsequent training can be provided. If a coding audit is only occurring quarterly or semi-annually, those undetected errors may have compounded over time, increasing the financial impact.

Audit Timing: Pre- or Post-Billing?

All providers should consider placing their audit process immediately after coding and prior to the bill being submitted. This allows for immediate and continuous feedback for the coders themselves, ensuring that the isolated errors do not become a recurring challenge.

In addition to the training value of immediate feedback, pre-billing audits can identify coding errors that would ultimately result in denials or re-billing when discovered later. High volumes of re-billing increase the risk of external audits from regulators and payers, and overturning denials is an expensive and time-consuming process.

Final Thoughts

Quality care is every provider’s goal and every patient’s expectation. Having a robust medical coding operation reinforced with a proactive coding audits program—either internal coding audits or via an external audit company— supports both stakeholders. Conducting coding audits on a monthly basis using a select but well-chosen sample of cases will help correct issues, ensure accuracy, maintain compliance with quality benchmarks, and identify areas of improvement, all while assuring the correct reimbursement for claims and reducing improper payments.

While each organization will have unique circumstances impacting how they approach coding and auditing, following the best practices outlined above will help ensure encounters are coded accurately, providers are reimbursed accordingly, and the organization can fund their mission to continue delivering quality service to its community.

Medical Coding Audits Frequently Asked Questions

Medical coding auditing ensures coding accuracy, accurate reimbursement, accurate reporting, coder education, and increased compliance.

Monthly audits are recommended to detect errors and provide timely training.

Pre-billing audits are preferred, as they provide immediate feedback and prevent denials or re-billing.

Current Procedural Terminology (CPT), Healthcare Common Procedure Coding System (HCPCS), and International Classification of Diseases (ICD).

Discover the potential of Streamline Health’s eValuator medical billing and coding software, RevID charge capture software, and Compare chargemaster management products designed to optimize healthcare financial performance. To get a glimpse of our revenue cycle management solutions, simply sign up for a live demo. Experience the efficiency and increased revenue potential, and rest assured that we are committed to your satisfaction. You only stand to gain by exploring our cutting-edge products!