For healthcare organizations, effective care is based on the unique characteristics of the patient. When a provider submits a bill (or ‘claim’) for payment, it is also subject to rather unique characteristics that influence if, how, and when it will be paid. Understanding those characteristics and successfully factoring them into preparing the claim helps ensure the health insurance company, commonly referred to as the payer, will pay it quickly and fully.

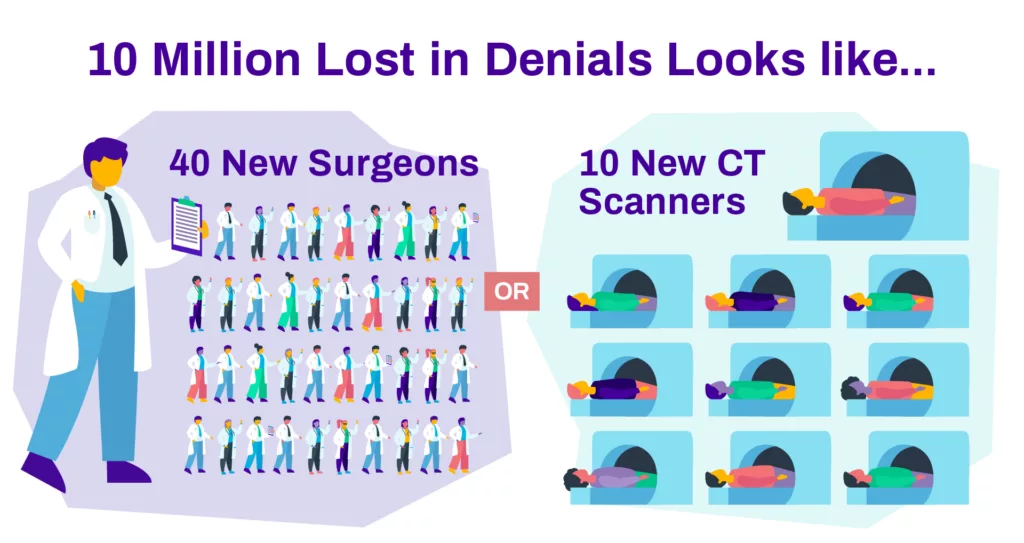

In many cases, there are issues with the claim and the payer will deny, or at least delay, payment until the provider has responded to the suspected issues. Payment delays and denials are a major challenge for provider organizations, with an average of nearly 20% of claims being initially denied upon receipt by the payer. The estimated impact of denials is approximately 2% of net patient revenue, so a mid-sized hospital with $500M in revenue could be losing $10M every year to medical claim denials.

Contents

Denials Management Impact on Financial Performance

Claims denials have a domino effect on the overall financial performance of the healthcare organization. First and foremost, it prevents cash from being available to meet payroll and pay other bills such as utilities, food service, etc. It also hinders the ability to invest in new equipment or services. Additionally, it means that the organization will have to invest more time and resources into reviewing each denial, assessing if it can be appealed, and, if so, researching and refiling it. These are additional expenses being incurred just to be reimbursed for care that’s already been delivered, which makes the denial management process a cost center for the organization.

While it’s unreasonable to expect that all claims will be accepted as-is and therefore there will be no denials, it’s a realistic goal to reduce preventable denials to less than 2% of all claims. Achieving this will require a thorough understanding of the types of denials, how and where the issues are occurring, and then developing a denials management strategy.

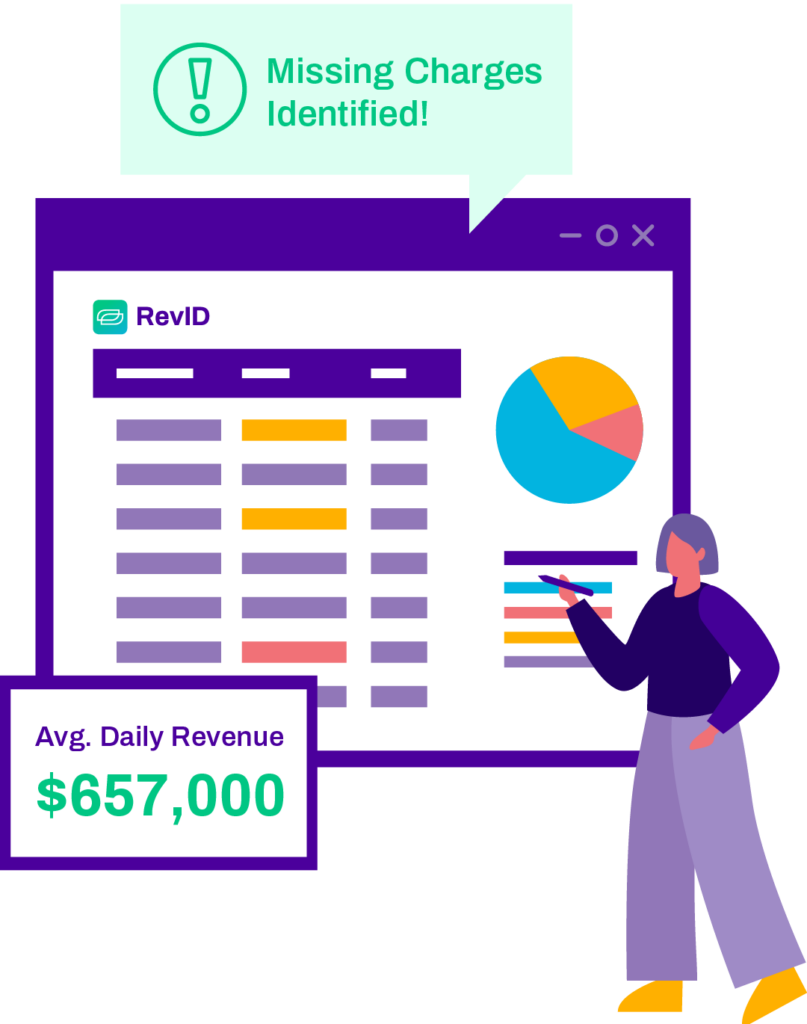

Reconcile 100% of charges daily and correct issues before submitting claims.

By ensuring optimized charge capture across all encounters, RevID prevents millions in revenue leakage while freeing up your staff to focus on more important tasks. Check out RevID below!

Type of Denials

At a high level, there are two types of basic denials: hard denials and soft denials. A hard denial represents a firm refusal by the payer to pay the claim. Contesting a hard denial requires a formal appeal process from the provider and in many cases, the provider will choose to skip the appeals process and abandon the claim, which results in lost revenue.

Soft denials are those denials in which the payer contests one or more data points in the claim, which opens the door for the provider to revisit the claim, revise the supporting data and re-submit it for payment. Commonly, soft denials involve missing data or a lack of documentation to support one or more elements of the denied claim.

Soft denials represent the majority of claims returned by payers and the providers have teams dedicated to reviewing and resubmitting them for payment.

Check out our Video Guide on Denials Management

Reasons for Denied Claims

According to Becker’s Healthcare, providers report that stated reasons for denied claims fall into the categories below, ranked by the frequency in which they’re cited in payer denials:

- Prior Authorizations

- Issues with eligibility

- Inaccuracies in coding

- Incorrect modifiers

- Failure to meet submission deadlines (timely filing)

- Inaccuracies in patient information or claim data

Understanding the above categories is key to assessing how to best develop a denials prevention strategy that mitigates their impact on operational and financial performance.

Let’s review each category with more context on how they contribute to denied claims.

Prior Authorization

Authorization is the process of determining whether or not a medical service, diagnostic procedure, treatment plan, prescription drug, or supporting medical device is medically necessary. This is sometimes referred to as prior authorization, prior approval, or precertification by the insurer. It means that, before certain elements are provided to the patient, the provider must check with the payer and provide the necessary supporting information to ensure the element(s) in question is appropriate and justified for the patient’s care.

The details for services and their related prior authorization requirements are clarified in the payer’s contract with the healthcare organization.

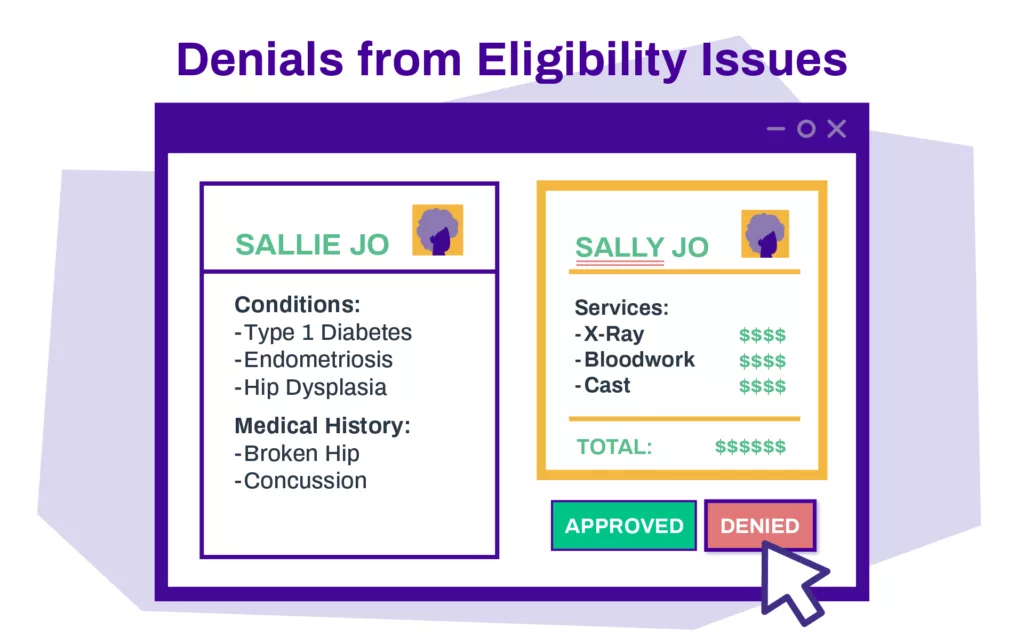

Eligibility Issues

Eligibility issues often stem from not fully capturing or understanding the patient’s coverage from the payer. It often occurs when the provider fails to confirm the patient’s insurance/payer information during preregistration for the service encounter, but can also be a matter of incorrect or missing patient data such as the current address or date of birth. Many provider organizations have a standing policy to scan the patient’s ID and insurance card before all encounters to help preempt these issues as well as to perform eligibility verification.

Coding Inaccuracies

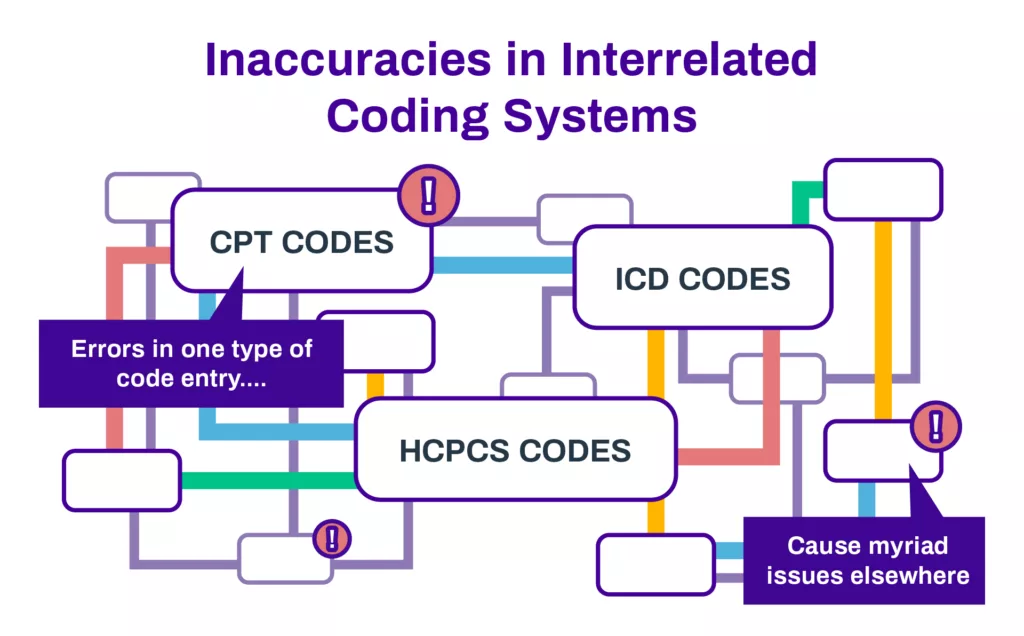

Perhaps the most complicated of claims denials involve issues with the coded data. In medical coding, a certified professional coder converts the details of a patient encounter into a billable claim. Medical coding is managed by the health information management department and includes data from all aspects of patient care from admission to release.

During the coding process, this wide range of clinical, billing, and administrative data is configured into alphanumeric codes including CPT (Current Procedural Terminology) codes, HCPCS (Healthcare Common Procedure Coding System) codes, and the International Disease Classification (ICD) codes. Much of this information is interrelated and myriad issues can arise from the resulting coded data.

While providers understand the importance of coding accuracy, the desire to get claims completed and bills submitted as soon as possible often means there isn’t enough time or resources to confirm coding accuracy prior to billing.

Incorrect Modifiers

Denials based on incorrect modifiers are essentially a subset of the previous category, coding inaccuracies. When using certain procedure codes, modifiers are a two-digit add-on used to denote an alteration of the standard use of this procedure code.

A summary of these variations is provided below:

In each of the above scenarios, a modifier summarizing the departure from the standard interpretation of the procedure would require documentation to validate its use. Not including the supporting documentation that validates the departure would likely result in the claim being denied until such corroborating evidence is provided.

Timely Filing, or Failure to Meet Submission Deadlines

Like prior authorizations, timely filing deadlines are established in the contract between the paying entity and the healthcare provider. In essence, there will be a certain period, such as 30 days, after a specific service has been delivered that the provider can submit a claim for payment.

In most cases, this type of denial will fall under the ‘hard denials’ category for the simple reason that the deadline to submit a claim for the associated care services has passed, and thus represents lost revenue. One exception to this occurs when the provider provided the claim to the payer within the designated filing period, but the payer failed to acknowledge receipt of the claim in a timely manner and the resulting gap extended beyond the timely filing window.

Don’t let denials continue to drain your revenue & resources.

Our eBook is packed with expert advice and best practices for minimizing denials and boosting your bottom line.

Download your copy today!

Inaccuracies in Patient Data and Missing/Inaccurate Claim Data

This is a more generalized category that encompasses a range of potential issues in the claim. It can include inaccurate, incomplete, or contradictory information regarding the patient’s coverage with the payer. Prior to service, perhaps the office failed to confirm the patient’s current address on file, and a previous address was submitted instead. It could be something as complex as the patient’s coverage shifting within an existing payer, such as previously being on the firm’s PPO (preferred provider organization) plan but then transferring to an HDHC (high deductible healthcare) plan from the same insurer. In other cases, it can be something as simple as a required field being left blank.

Keys to Preventing Claims Denials

Like many healthcare issues, the key to effective denials management is to prevent them in the first place. A recent study suggests that up to 86% of denials are preventable, so it’s incumbent on providers to assess and implement a sound denials prevention strategy.

Below are some key areas to explore in your efforts to prevent the issues behind denied claims.

Analyze & Prioritize Your Current Denials

Your current payer responses hold the key to assessing your denial trends. What issues are being cited; are they focused on authorizations and eligibility? If so, then the solution could be reviewing your pre-service workflows where staff is tasked with confirming the patient’s details. Is a certain payer rejecting claims at a higher frequency than others? Perhaps establish a unique pre-bill checklist for that payer and have someone verify the data beforehand and take corrective action as needed.

Similarly, looking at the dollar amounts involved can help prioritize your efforts. A certain issue may be prevalent in your denied claims, but if the impacted dollar amounts are very small, it may be more prudent to address a less common issue that’s affecting rejected claims with much larger dollar values. Identifying the denials with the greatest impact on the bottom line can help ensure you’re aligning your efforts and resources appropriately.

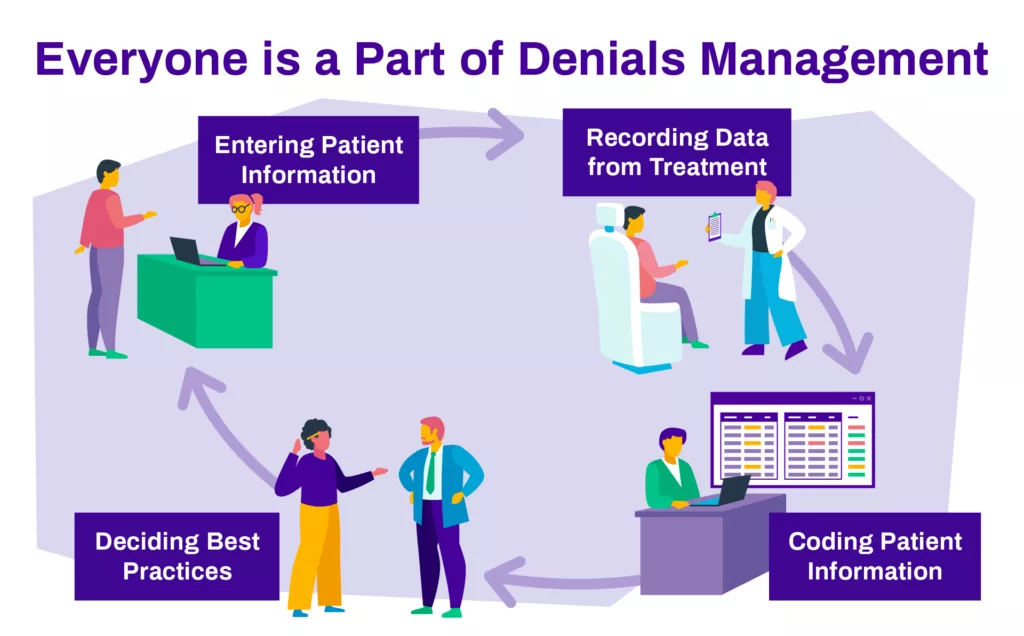

Engage and Educate Your Teams

Many of the issues impacting denials are actually managed by teams outside of your revenue cycle department. Patient eligibility and verification are often handled by billing department or point of service staff, so it’s crucial that they appreciate the importance of confirming these details accurately and consistently for every encounter. If your root cause analysis indicates persistent eligibility or verification issues, share the data with these teams and clarify the current processes to assess if improvements can be made. If adjustments are made, be sure to monitor performance to see if the issue persists. If it does, revisit and try again. If the related denial rates decrease, be sure to share this with your teams to acknowledge your mutual success in reducing rejected claims.

Leverage Partners and/or Technology

While all providers experience denials, the unique nature of each organization’s internal processes, clinical offerings, and payer contracts can make it challenging to easily find and address the root causes. In many cases, bringing in outside assistance can yield tremendous insights. Third-party consultants who specialize in optimizing revenue cycle operations can analyze your claims management and denial trends and objectively assess your processes and systems against industry best practices. With this basis, they can propose a denials prevention program featuring the needed corrective measures.

In a similar move, many providers look to adding revenue cycle technology to provide much-needed automation (to increase productivity and staff focus) and analysis (to better understand the factors influencing operational and financial performance.) With new data-based insights and teams less constrained by manual processes, many providers can make substantial strides in reducing the issues behind claims denials.

Denials Management is a Journey, Not a Destination

Given the complexity of healthcare delivery and payer requirements, eliminating claims denials entirely isn’t a realistic goal. However, performing root cause analysis to establish a proactive denials management strategy will help providers make continuous improvements that reduce future claim denials and therefore increase cash flow and improve overall financial performance.

Denials Management Frequently Asked Questions

Hard denials, which are firm refusals to pay, and soft denials, which contest claim data points but can be revised and resubmitted.

Prior authorization, eligibility issues, coding inaccuracies, incorrect modifiers, failure to meet submission deadlines, and inaccuracies in patient or claim data.

By analyzing and prioritizing current denials, engaging and educating teams, and leveraging partners or technology to improve processes and systems.

No, but providers can continuously improve by establishing a proactive denials management strategy, reducing future claim denials, and improving financial performance.

Discover Streamline Health’s innovative revenue management solutions to optimize your healthcare financial performance. Experience the benefits of our medical billing and coding software, charge capture software, and chargemaster management products under one roof. Our comprehensive platform offers the following:

- Seamless integration with your existing systems

- Streamlined workflows and maximized revenue capture

- Enhanced efficiency through advanced analytics and reporting

- Tailored solutions for healthcare providers

Start your journey toward an optimized revenue cycle with a demo of our automated revenue cycle management software. Explore our products or connect with our sales team to find the perfect fit for your organization.