The pursuit of improved performance is top-of-mind for financial leaders. Razor-thin margins, increasing payor delays and denials, staffing costs and operational difficulties make for an ever-changing environment.

In today’s complex world of revenue cycle management, medical coding audits are a key strategy providers must employ. Auditing can be accomplished pre- and/or post-billing. Each contributes to revenue and coding integrity. However, one methodology is key to mitigating today’s revenue and coding integrity challenges: pre-bill auditing.

Contents

The Rising Challenge: Denial Rates on the Upswing

Denial rates in the healthcare sector have emerged as an overarching challenge, impacting the financial stability of every provider organization. According to HFMA’s 2021 research, among the $3 trillion in total claims submitted by healthcare organizations, $262 billion were denied. A pre-pandemic survey by AHA, indicated that 89% of all hospitals and health systems witnessed an uptick in denials, and in the post-pandemic era, 30% of health care leaders reported a continued surge between 10-15% (Experian state of claims study). Attributed to the complexity of coding, continuously evolving payer requirements, and documentation intricacies; denials pose a significant threat to revenue streams, cash flow and the bottom line. The pressing need to address these obstacles has given rise to the strategic use of medical coding audits as a proactive defense against potential pitfalls in the payment process.

The Case for Medical Coding Audits: Balancing Costs and Benefits

While the prospect of pre- &/or post-bill medical coding audits might appear costly at first glance, the advantages gained from their implementation far surpass the associated costs when done right. The Experian study underscored the significance of coding inaccuracies, ranking them in the top three reasons for claim denials. Medical coding audits play a crucial role in securing an organization’s financial health by detecting, at minimum, some of the following:

- Accurate identification of principal and secondary diagnosis(es) and procedure codes

- Review of secondary diagnosis codes impacting SOI/ROM

- Accurate MS-DRG/APR-DRG/APC/EAPG assignment

- Focus areas of review by the OIG, RAC and CERT auditors

- Bundling/unbundling and missing or incorrect modifier usage

- Incorrect or omitted codes

- Billing &/or charging errors

- Clinical validation opportunities

- Documentation issues

Comprehensive audits mitigate risks, identify missed revenue opportunities, and drive quality improvement. It is essential that medical coding audits are not merely perceived as a reactive measure but as a proactive strategy to prevent denials, maintain compliance, reduce unnecessary rework/rebilling and to optimize revenue, coding, and documentation integrity.

Pre-bill Auditing: Anticipating Challenges Before They Arise

Pre-bill auditing emerges as the smartest preemptive measure an organization can take to help identify coding and revenue integrity optimization opportunities, charge errors and discrepancies that may lead to payment delays or claim denials, all before the final billing stage. Once a bill is issued, the “horse is out of the barn”. Post-bill audit findings typically result in a rebilling effort, adding rework to an already stressed process that could increase third-party scrutiny… nothing anyone needs or wants.

Assuring clean claims go out the door the first time is critical. The benefits of pre-bill auditing include error prevention and beyond, delivering:

- Reduced billing errors before claims are submitted to insurance to minimize denials or delayed payments

- Improved clean claim rates by addressing coding issues before claim submission, resulting in a reduction in reimbursement delays

- Enhanced cash flow by ensuring coding issues are corrected early in the revenue cycle, supporting faster claim approval

- Avoided compliance issues and audit triggers

- Streamlined claim submission and reduced need for appeals and resubmissions

- Increased speed to cash

- Enhanced reimbursement accuracy by ensuring that the coding reflects the services provided

- Supported staff training and development to prevent future errors

- Reduced rework associated with rebilling and addressing delays and denials

The proactive nature of pre-bill audits is emphasized by their ability to move case reviews closer to the middle of the revenue cycle. This strategic shift allows organizations to proactively address issues, rather than waiting for 30, 60, or 90 days until claims are denied by payers and coding error trends are established. An additional benefit is improved clean claim rates in addition to faster, complete payments with reduced denials.

The impact a pre-bill auditing process can have on revenue and coding integrity is also greatly influenced by the amount of pre-bill auditing done. Auditing certain kinds of encounters (such as those most likely to produce a known payment delay or denial) is good. Leveraging technology to audit 100% of encounters so human auditors focus on those encounters that post the most risk for over- and under-billing is the ideal.

Safe to say pre-bill medical coding auditing is the best practice. If leveraging technology that reviews 100% of encounters pre-bill, even the “needles in a haystack” encounters will be reviewed, providing trend information before errors become engrained in coding practices.

Analyze 100% of coded cases before billing and recover millions in missing revenue.

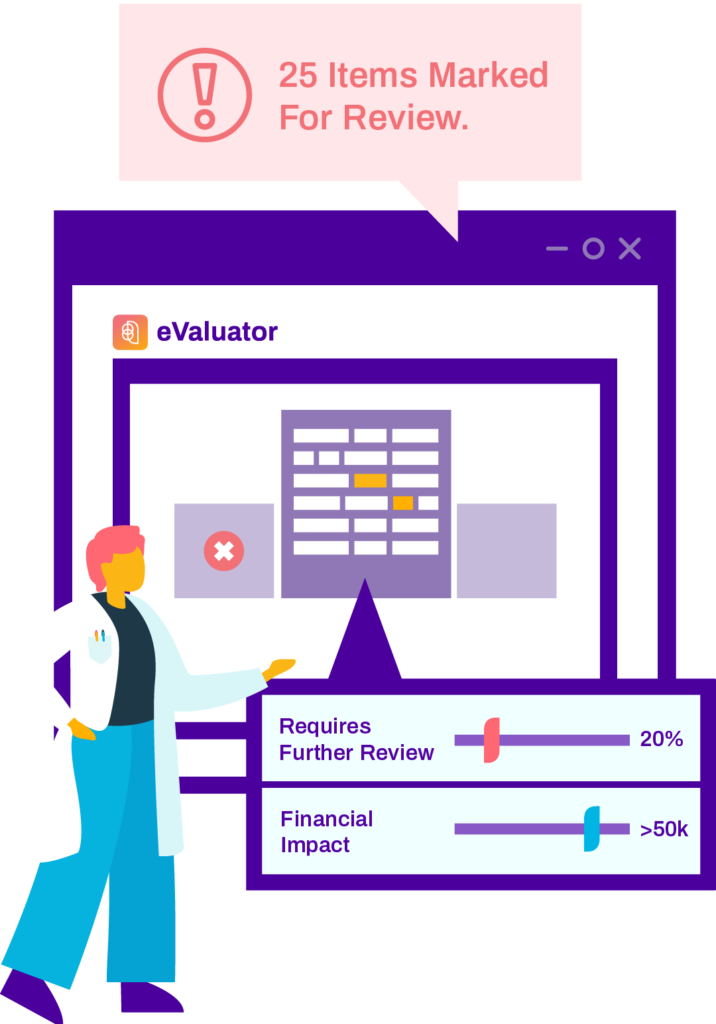

As healthcare’s only automated pre-bill coding analysis solution with real-time results, Streamline Health eValuator™ enables you to easily identify, quantify and expedite correction of the issues with the greatest impact on your revenue integrity and financial performance from your Inpatient, Outpatient, and Pro-Fee care.

Post-bill Auditing: Retrospective Insights for Ongoing Improvement

In contrast, post-bill auditing takes a retrospective stance, analyzing medical codes assigned to a patient’s medical record after the claim has been submitted. This retrospective approach allows time to study and identify patterns and trends in errors, denials and navigate payor disputes. While post-bill auditing may not prevent denials proactively, it can serve as a tool for prioritizing areas of improvement and education. Post-bill auditing can be utilized when resolving issues with payers and providing data and evidence to support disputes or appeals.

While better than no formal pre-bill auditing program, a post-bill auditing program comes with its set of challenges, including potential delays in education and the risk of continuous errors persisting until identified in the retroactive analysis. The potential need for rework to recode, a coordinated effort with Patient Financial Services and Health Information, and the meticulous tracking of rebills to meet payor deadlines for rebilling are considerations that organizations must navigate.

Pros and Cons: Weighing the Impact of Auditing Approaches

A common concern for pre-bill auditing, while effective in preventing denials, is the increase in delays in discharge not final billed (DNFB). Turnaround time for pre-bill auditing should be short (example, 1 to 2 days). Staffing a pre-bill auditing program can be a challenge, especially without technology to support the effort’s need for speed.

On the other hand, post-bill auditing may result in a delay in education, allowing continuous errors to persist, resulting in an increase in denials and patterns of incorrect coding and billing. Post-bill audits tend to be smaller in volume. Small audit samples, like 100 or 200 encounters per quarter, often miss key patterns in coding and billing errors, and most certainly miss those “needle in a haystack” encounters that can lead to significant revenue loss and learning opportunities.

Conclusion

In healthcare revenue cycle management, the strategic relationship between pre-bill and post-bill auditing forms a cohesive integration. Pre-bill auditing proactively prevents errors, enhances efficiency, and safeguards revenue while post-bill auditing offers retrospective insights, enabling organizations to learn from past mistakes, prioritize education and confidently navigate payer disputes with evidence.